Some insurance policy suppliers automate much of their client service, which can be discouraging when you are a customer. Consumer satisfaction scores will certainly illustrate how consumers feel regarding their experience with the various insurance companies.

auto insurance credit score prices insurance

auto insurance credit score prices insurance

The way information gets to you as well as the means the company connects with you throughout the period of your partnership with them must be a major factor to consider. insurance. There are numerous third-party business that examine insurer reputations with their consumers. The as well as are the most well recognized as well as reliable resources for this info.

Underwriter Financial Toughness The economic stamina of the underwriting company is an aspect that we value when selecting a provider. It's tough to picture that your insurance coverage provider might be not able to pay the worth owed to you in the occasion of a covered loss.

cheapest car insurance cheap insurance liability insurance company

cheapest car insurance cheap insurance liability insurance company

insurance liability insure cheap car insurance

insurance liability insure cheap car insurance

A lot of the firms we discuss below are public firms, whose economic details is publicly offered for anyone thinking about seeing it - car insurance. If monetary stamina of the insurance provider is a sticking point for you, you can watch a business's financial documents and also figure out on your own exactly how stable and also credible that company is - auto.

The Facts About Metlife: Insurance And Employee Benefits Revealed

These financial rating firms are: Started in 1899, A.M. Ideal is a Country Wide Recognized Statistical Rating Company (NRSRO) in the United States. They focus entirely on ranking companies in the insurance sector.

Every one of the companies that we suggest are very strong according to these significant score companies - insurance. Prices & Quotes Rates can be tough to review when contrasting business auto insurance coverage companies. The majority of the time, insurance companies won't (or merely can not) offer sufficient insight right into rates up until they get details from you (cars).

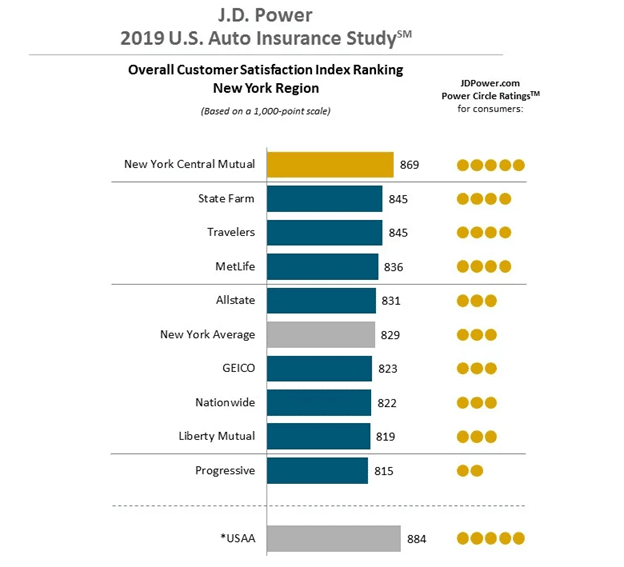

In most cases, getting a quote can be a time-consuming procedure that requires a large amount of information as well as paperwork. Among the couple of understandings right into prices you can discover without obtaining and comparing quotes is the information that J.D. Power offers in their insurance policy industry research studies. One of the metrics that they evaluate insurance policy customers on is their fulfillment with the pricing of their plans.

Not all firms we recommend are on the desirable end of this spectrum, since in some cases greater quality plans are extra costly - insure. Additionally, these scores often incorporate a vast variety of policies as well as are not necessarily representative of specific sorts of insurance coverage, such as commercial car insurance. Still, the info that is offered can be an useful beginning factor if pricing is a primary concern.

Unknown Facts About Watching Your Wallet: How To Put The Brakes On Rising Car ...

Small companies also need to take into consideration whether any one of their staff member's individual lorries need to be taken into consideration for insurance coverage. New tiny companies may not have their own fleet of vehicles, as well as rely on staff members to give their very own transportation (credit). If workers of a local business are utilizing their personal vehicles for service procedures, the company purchase worked with as well as non-owned auto coverage, which safeguards the company from damages to vehicles that it does not possess.

money automobile vehicle insured car

money automobile vehicle insured car

This can streamline payment and frequently brings about price cuts from bundling business automobile with other insurance plan, like workers compensation and general responsibility. Considering the expenses as well as insurance coverage that local business need, some industrial car insurer are a better fit than others. With these variables in mind, along with the discounts offered for small companies, Construction Coverage rates these carriers the: Next Insurance Policy, Progressive, Farmers Ideal Business Vehicle Insurance Companies In order to identify the most effective business auto insurance provider, we investigated every one of the top business car insurance coverage suppliers.

liability cheaper auto Additional resources insurance cheapest affordable

liability cheaper auto Additional resources insurance cheapest affordable

Dynamic Commercial Auto (Finest General) Modern # 1 in Industrial Vehicle Insurance Coverage Best Total Progressive is our leading recommendation for commercial vehicle insurance general as well as additionally one of our top-rated commercial vehicle insurer. Established in 1937, Progressive has risen to a powerful setting as the biggest industrial vehicle insurance provider by premiums written.

Pros Progressive's usage-based insurance program can lower expense and also boost safety and security, Uses among one of the most extensive set of insurance coverage alternatives of any kind of insurance firm on the market Fools Racked up slightly worse than competing insurance companies in a current client contentment study performed during COVID Progressive's commercial automobile policy choices consist of basic insurance coverages for liability, physical automobile damage, accident, clinical payments, and without insurance or underinsured drivers for a variety of service automobiles (cheaper auto insurance).

Too Big To Ignore: The Business Case For Big Data Can Be Fun For Anyone

Progressive was recently identified with an A+ economic toughness score by A.M. Ideal. Moodys as well as S&P rated them at Aa as well as AA specifically, all suggesting Progressive is monetarily strong. car. The Bbb gives Progressive an A+, but one downside of Progressive is that by various other actions of consumer satisfaction, they lag a little behind their rivals.

Following Commercial Car (Best for Local Business) Following Insurance Policy # 2 in Industrial Car Insurance Best for Small Business Next Insurance policy is a more recent option in the industrial automobile insurance coverage market - auto. Next was founded in 2015 with an objective of far better offering small company insurance policy customers with a simplified buying experience and tailored, cost effective policies (insurance).

If you begin a quote with your lorry, make, as well as version yet no lorry recognition number (VIN), your price might transform after you enter the full VIN. If you don't supply details concerning mishaps you have actually been in (also minor ones), your policy rate may be higher. If you forget to provide details concerning the driving background for the drivers under the policy, that might bring about a higher price.

You'll require: A valid chauffeur's permit Car Identification Number (VIN) for all vehicles Resolve where the automobile will be kept Driving background for you and any type of various other chauffeurs How to contrast vehicle insurance coverage quotes. business insurance. When you're doing a contrast of car insurance coverage quotes or prices, see to it they're for the same: Protections Deductibles Limits Contrasting cars and truck insurance can be a simple process once you understand what components of a quote you need to compare - perks.

The 7-Second Trick For Metlife: Insurance And Employee Benefits

Choose on car insurance policy coverages. When you compare car insurance rates, make sure you select the very same set of coverages for each quote (perks). Protection demands vary as well as some insurance coverages are optional.

If you select a higher insurance deductible, it may lower your costs. Make sure you pick the same deductible for each quote when comparing auto insurance policy prices with various insurance providers. Evaluation as well as contrast obligation restrictions.